Delving into Investing in SmallCap Index Funds: A Global Perspective, this introduction immerses readers in a unique and compelling narrative, with casual formal language style that is both engaging and thought-provoking from the very first sentence.

SmallCap Index Funds offer a diverse and dynamic investment opportunity that can yield significant returns in the global market. As we explore the intricacies of these funds, we uncover a world of potential for investors seeking growth and diversification.

Overview of SmallCap Index Funds

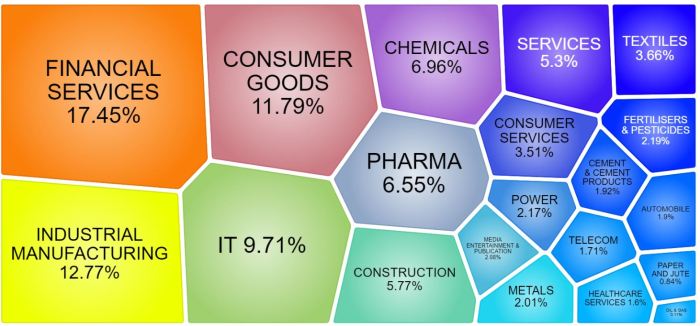

SmallCap Index Funds are investment funds that track the performance of small-cap stocks within a specific index, such as the Russell 2000 or the S&P SmallCap 600. These funds provide investors with exposure to a diversified portfolio of small-cap companies, which are typically smaller in market capitalization compared to large-cap or mid-cap companies.

Differences from Other Index Funds

Unlike large-cap or mid-cap index funds, SmallCap Index Funds focus on small-cap stocks, which have the potential for high growth but also come with higher volatility and risk. Small-cap companies are known for their agility and potential to outperform larger companies in certain market conditions.

Benefits of Investing in SmallCap Index Funds

- Diversification: SmallCap Index Funds offer a diversified exposure to a broad range of small-cap stocks, reducing the risk associated with investing in individual small-cap companies.

- Potential for High Growth: Small-cap companies have the potential for significant growth, which can lead to higher returns for investors compared to large-cap companies.

- Liquidity: Investing in SmallCap Index Funds provides liquidity, as these funds are traded on major exchanges and can be easily bought or sold.

Risks Associated with Investing in SmallCap Index Funds Globally

- Volatility: Small-cap stocks can be more volatile than large-cap stocks, leading to fluctuations in the value of SmallCap Index Funds.

- Lack of Analyst Coverage: Small-cap companies may not receive as much analyst coverage as larger companies, making it challenging to obtain information for investment decisions.

- Market Risk: Global economic conditions and market fluctuations can impact small-cap stocks, affecting the performance of SmallCap Index Funds.

Global Market Analysis

Global market analysis plays a crucial role in understanding the performance of SmallCap Index Funds across different regions. Let’s explore examples of successful SmallCap Index Funds in various global markets and compare their performance in developed countries versus emerging markets.

Successful SmallCap Index Funds in Different Global Markets

- In the United States, the Vanguard Small-Cap Index Fund has shown consistent growth and outperformed many actively managed funds over the years.

- In Europe, the iShares MSCI Europe Small-Cap ETF has been a popular choice among investors seeking exposure to small-cap stocks in the region.

- In Asia, the SPDR S&P Emerging Asia Pacific ETF has provided investors with access to small-cap companies in emerging markets like China, India, and South Korea.

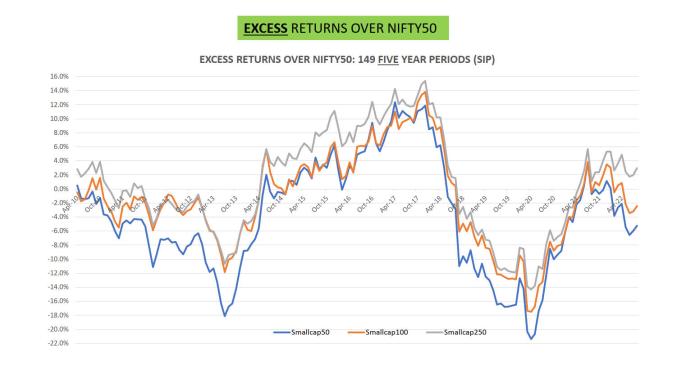

Performance of SmallCap Index Funds in Developed Countries vs. Emerging Markets

- SmallCap Index Funds in developed countries often exhibit lower volatility and more stable returns compared to those in emerging markets due to established regulatory frameworks and market conditions.

- However, SmallCap Index Funds in emerging markets have the potential for higher growth opportunities, albeit with increased risk and volatility.

- Investors looking for diversification and higher returns may choose to allocate a portion of their portfolio to SmallCap Index Funds in both developed and emerging markets.

Impact of Geopolitical Events on SmallCap Index Funds

- Geopolitical events such as trade wars, political instability, and economic sanctions can significantly impact the performance of SmallCap Index Funds on a global scale.

- Uncertainty stemming from geopolitical tensions can lead to market volatility and affect investor sentiment, influencing the returns of SmallCap Index Funds.

- Investors need to stay informed about geopolitical developments and their potential implications on the global economy to make informed decisions regarding their investments in SmallCap Index Funds.

Factors Influencing SmallCap Index Funds

Investing in SmallCap Index Funds is influenced by various factors that can impact their performance in the global market. Economic indicators, growth of SmallCap companies, and currency fluctuations play a significant role in determining the success of these funds.

Economic Indicators

Economic indicators such as GDP growth, inflation rates, and unemployment levels can have a direct impact on the performance of SmallCap Index Funds. For instance, a strong GDP growth can signal a healthy economy, leading to increased investments in SmallCap companies and subsequently boosting the performance of the funds.

Growth of SmallCap Companies

The growth and success of SmallCap companies directly influence the performance of SmallCap Index Funds. Factors such as revenue growth, market expansion, and product innovation can attract investors to these companies, driving up the value of the index funds that hold their stocks.

Role of Currency Fluctuations

Currency fluctuations can significantly affect SmallCap Index Funds, especially those with exposure to international markets. Changes in exchange rates can impact the value of foreign investments held by the funds, leading to fluctuations in their overall performance. Investors need to consider the impact of currency movements when investing in SmallCap Index Funds with global exposure.

Strategies for Investing in SmallCap Index Funds

Investing in SmallCap Index Funds can be a lucrative opportunity for investors looking to diversify their portfolio and maximize returns. Here, we will discuss different investment strategies, tips for diversification, and the importance of research when selecting SmallCap Index Funds.

Maximizing Returns with SmallCap Index Funds

- Regularly Rebalance Your Portfolio: Adjusting your investment allocation can help maintain an optimal balance between risk and return.

- Utilize Dollar-Cost Averaging: Investing a fixed amount at regular intervals can help reduce the impact of market volatility on your investments.

- Consider Sector Rotation: Rotating investments between sectors can help capitalize on sector-specific trends and opportunities.

Diversifying a Portfolio with SmallCap Index Funds

- Invest in Global SmallCap Index Funds: Spread your investments across different regions to reduce geographic risk and take advantage of global market opportunities.

- Include LargeCap and MidCap Funds: Combining SmallCap Index Funds with LargeCap and MidCap funds can provide a balanced portfolio with exposure to different market segments.

- Consider Alternative Investments: Adding alternative assets like real estate investment trusts (REITs) or commodities can further diversify your portfolio and reduce overall risk.

The Importance of Research and Due Diligence

- Understand the Fund’s Investment Strategy: Research the fund’s objectives, holdings, and performance track record to ensure it aligns with your investment goals.

- Assess Fund Manager Expertise: Evaluate the experience and track record of the fund manager to gauge their ability to deliver consistent returns over time.

- Monitor Economic and Market Trends: Stay informed about global economic conditions and market trends that could impact the performance of SmallCap Index Funds.

Final Conclusion

In conclusion, Investing in SmallCap Index Funds: A Global Perspective opens up a realm of possibilities for investors looking to expand their portfolios and capitalize on the exciting opportunities presented by small-cap companies worldwide. By understanding the nuances of these funds and staying informed about market trends, investors can navigate the global landscape with confidence and strategic foresight.

FAQ Insights

What are the key benefits of investing in SmallCap Index Funds?

Investing in SmallCap Index Funds provides diversification across a broad range of small-cap companies, which can result in potentially higher returns compared to individual stocks.

How do geopolitical events impact SmallCap Index Funds globally?

Geopolitical events can influence the performance of SmallCap Index Funds by affecting market sentiment and investor confidence, leading to fluctuations in fund values.

What role do currency fluctuations play in affecting SmallCap Index Funds?

Currency fluctuations can impact the returns of SmallCap Index Funds, especially for globally diversified funds, as changes in exchange rates can affect the value of international investments.

![Benefits of Servicing Your Air Conditioning Regularly [2024]](https://finance.radarcirebon.tv/wp-content/uploads/2025/07/Benefits-of-Air-Conditioning-Servicing-on-the-Regular-Featured-Image-980x551-1-120x86.jpg)