Exploring the timeless debate of Gold vs Silver: Which Precious Metal to Buy in Global Recession? sets the stage for a captivating journey through the world of precious metals. From their historical significance to their modern-day investment potential, this topic delves into the intricacies of these valuable assets.

Delving deeper into the comparison between gold and silver, this discussion aims to shed light on the factors that influence their prices, their role as safe haven assets, and the best investment strategies to navigate through economic uncertainties.

Introduction to Gold and Silver

Gold and silver have long been revered as precious metals with significant historical significance. These metals have been used for various purposes throughout human history, ranging from jewelry and currency to industrial applications and investments.

Industrial and Investment Uses

Gold and silver both have important industrial uses due to their unique properties. Gold is highly conductive and resistant to corrosion, making it valuable in electronics and aerospace industries. Silver is also known for its conductivity and is used in various electronic devices and solar panels.

Characteristics and Properties

Gold and silver differ in terms of color, density, and malleability. Gold is a yellow metal with a higher density compared to silver, making it more suitable for intricate jewelry designs. Silver, on the other hand, is known for its white luster and is commonly used in everyday items like cutlery and coins.

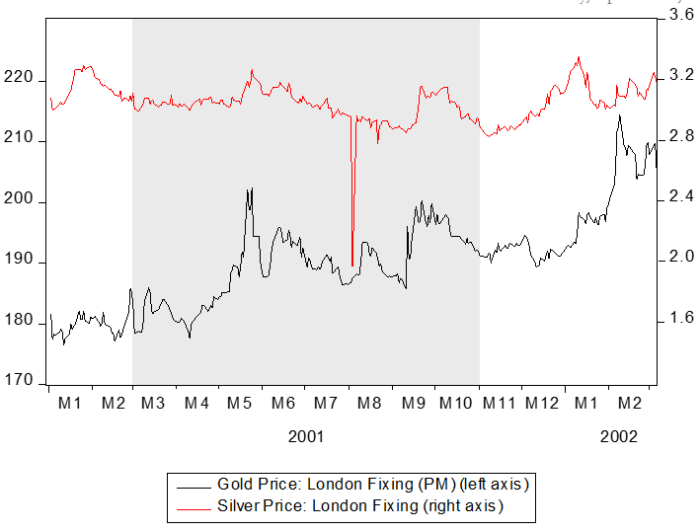

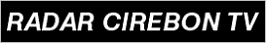

Factors Affecting Gold and Silver Prices

When it comes to understanding the pricing dynamics of gold and silver, various economic factors play a crucial role. These factors can significantly impact the value of these precious metals in the global market.

Economic Factors

- Interest Rates: Changes in interest rates by central banks can influence the prices of gold and silver. Typically, lower interest rates make holding gold and silver more attractive as they offer a hedge against inflation.

- Inflation: Gold and silver are considered as inflation hedges, meaning their prices tend to rise as inflation increases. Investors often turn to these metals to protect the value of their assets during times of high inflation.

- Economic Data: Economic indicators such as GDP growth, unemployment rates, and consumer confidence can impact the demand for gold and silver. Positive economic data may lead to lower demand for these metals as investors seek riskier assets.

Supply and Demand

- Supply Constraints: Limited supply of gold and silver due to factors like mining production or geopolitical issues can lead to higher prices. Conversely, an increase in supply can result in lower prices.

- Demand Trends: The demand for gold and silver is influenced by factors like jewelry consumption, industrial usage, and investment demand. Fluctuations in these demand drivers can affect the prices of these metals.

Geopolitical Events and Currency Fluctuations

- Geopolitical Uncertainty: Political instability, conflicts, or trade tensions can drive investors towards safe-haven assets like gold and silver, causing their prices to rise.

- Currency Movements: Gold and silver prices are inversely correlated with the strength of the US dollar. When the dollar weakens, gold and silver prices tend to rise as they become cheaper for holders of other currencies.

Gold vs. Silver as Safe Haven Assets

When it comes to seeking refuge during times of economic uncertainty, both gold and silver have long been considered safe haven assets. These precious metals tend to retain their value or even increase in price when traditional investments like stocks and bonds falter.

Let’s delve into how gold and silver stack up against each other in this regard.

Historical Performance in Recessions

During past recessions, gold has historically outperformed silver as a safe haven asset. For example, during the 2008 financial crisis, gold prices surged significantly, while silver experienced more volatility. Gold’s reputation as a reliable store of value during economic downturns has solidified its status as a preferred safe haven asset.

Hedge Against Inflation and Economic Downturns

Gold is traditionally considered a better hedge against inflation and economic downturns compared to silver. This is due to gold’s intrinsic value, scarcity, and universal acceptance as a form of currency. Investors often turn to gold as a way to protect their wealth during times of high inflation or economic instability.In contrast, while silver also serves as a hedge against economic uncertainty, its price movements are often more closely tied to industrial demand.

This can lead to higher volatility in silver prices compared to gold. However, some investors view silver as an attractive option for diversification within their precious metals portfolio.Overall, both gold and silver have their unique advantages as safe haven assets, but gold tends to be the preferred choice for investors looking to safeguard their wealth during turbulent economic times.

Investment Strategies for Gold and Silver

Investing in gold and silver can be a strategic move to diversify a portfolio and hedge against economic uncertainties. There are various investment strategies to consider when it comes to buying and holding these precious metals.

Physical Gold and Silver vs. ETFs or Mining Stocks

- Physical Gold and Silver:

- Pros:

- Provides a tangible asset that can be held directly.

- No counterparty risk compared to ETFs or mining stocks.

- Potential for privacy and confidentiality in ownership.

- Cons:

- Costs associated with storage and insurance.

- Lack of liquidity compared to ETFs or mining stocks.

- Possibility of theft or loss of physical assets.

- Pros:

- ETFs or Mining Stocks:

- Pros:

- Offers exposure to gold and silver prices without physical ownership.

- Increased liquidity and ease of buying and selling compared to physical assets.

- Potential for diversification through mining stocks in the precious metals sector.

- Cons:

- Subject to market risks and volatility.

- Dependent on the performance of the ETF or mining company.

- No direct ownership of physical assets.

- Pros:

Diversifying a Portfolio with Gold and Silver Investments

- Allocate a percentage of your portfolio to gold and silver to reduce overall risk exposure.

- Consider the correlation of gold and silver prices with other assets in your portfolio to determine the optimal allocation.

- Regularly rebalance your portfolio to maintain desired exposure to gold and silver based on market conditions.

- Explore different investment vehicles such as physical bullion, ETFs, mining stocks, or mutual funds to diversify effectively.

Summary

As we conclude our exploration of Gold vs Silver: Which Precious Metal to Buy in Global Recession?, it becomes clear that both metals have their unique advantages and considerations for investors. Whether you choose gold for its historical allure or silver for its industrial applications, understanding the dynamics of these precious metals is essential in making informed investment decisions.

Question Bank

Which metal is a better hedge against inflation- gold or silver?

Gold is traditionally considered a better hedge against inflation due to its historical value preservation, while silver also serves as a hedge but is more influenced by industrial demand fluctuations.

Are ETFs a better investment option for gold and silver compared to physical holdings?

ETFs provide a convenient way to invest in gold and silver without the need for physical storage, offering liquidity and diversification benefits compared to holding physical metals. However, some investors prefer physical holdings for long-term security.

How do geopolitical events impact the prices of gold and silver?

Geopolitical events can create uncertainty in financial markets, leading to a flight to safety in assets like gold and silver, causing their prices to rise as investors seek stability during turbulent times.

![Benefits of Servicing Your Air Conditioning Regularly [2024]](https://finance.radarcirebon.tv/wp-content/uploads/2025/07/Benefits-of-Air-Conditioning-Servicing-on-the-Regular-Featured-Image-980x551-1-120x86.jpg)