Exploring the battle between Crypto IRA and Traditional IRA in 2025, this introduction sets the stage for an intriguing discussion that delves into the nuances of both investment options.

Providing a detailed overview of the contrasting features and benefits of each IRA type, readers are drawn into the world of cryptocurrency and traditional assets.

Overview of Crypto IRA and Traditional IRA

Crypto IRA and Traditional IRA are two popular retirement account options with distinct features and benefits.

Crypto IRA

A Crypto IRA is a self-directed individual retirement account that allows investors to hold cryptocurrencies such as Bitcoin, Ethereum, and other digital assets. Unlike Traditional IRAs, Crypto IRAs offer potential for high returns but come with higher risks due to the volatile nature of the crypto market.

- Key Features:

- Investment in cryptocurrencies

- Greater potential for high returns

- Self-directed investment choices

- Benefits:

- Diversification of retirement portfolio

- Potential for significant growth

- Flexibility in investment options

- Eligibility Criteria:

- Must have earned income

- Meet income limits set by IRS

- Limitations:

- High volatility in cryptocurrency market

- Regulatory uncertainties

- Security risks associated with digital assets

Traditional IRA

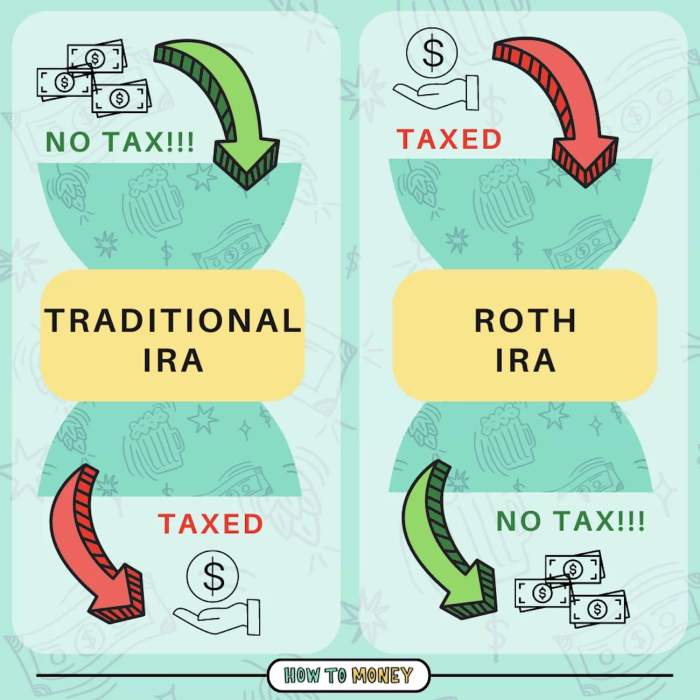

Traditional IRA is a tax-advantaged retirement account where contributions are made with pre-tax dollars, and investments grow tax-deferred until withdrawal during retirement. Unlike Crypto IRAs, Traditional IRAs are more stable but offer lower growth potential.

- Key Features:

- Investment in traditional assets like stocks, bonds, and mutual funds

- Tax-deferred growth of investments

- Contributions made with pre-tax dollars

- Benefits:

- Stable and predictable growth

- Tax advantages on contributions and growth

- Lower risk compared to volatile cryptocurrency investments

- Eligibility Criteria:

- Must have earned income

- No age limit for contributions

- Limitations:

- Lower growth potential compared to high-risk investments

- Early withdrawal penalties before age 59 ½

- Required minimum distributions after age 72

Investment Options and Growth Potential

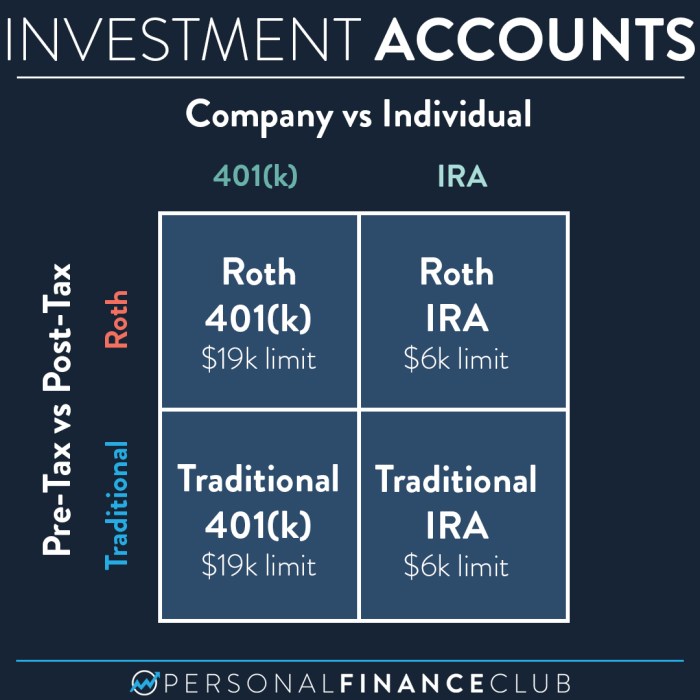

Cryptocurrency IRA and Traditional IRA offer distinct investment options with varying growth potentials over time. While Traditional IRAs focus on conventional assets like stocks, bonds, and mutual funds, Crypto IRAs enable investment in digital currencies like Bitcoin, Ethereum, and other cryptocurrencies.

Let’s delve into the differences in investment options and growth potential between the two.

Investment Options

- Crypto IRA: Allows investors to diversify their portfolio with digital assets, providing exposure to the volatile yet potentially high-growth cryptocurrency market.

- Traditional IRA: Primarily focuses on traditional assets such as stocks, bonds, and mutual funds, offering stability but potentially limiting growth opportunities compared to cryptocurrencies.

Growth Potential

-

Cryptocurrency Investments:

Cryptocurrencies have shown significant growth potential in recent years, with some digital assets experiencing exponential price increases. However, this growth comes with high volatility and risk.

-

Traditional Assets:

While traditional assets offer stability and lower risk, they may have slower growth rates compared to cryptocurrencies. The growth potential of stocks and bonds is generally more predictable but may not match the rapid growth seen in the crypto market.

Risks Involved

- Investing in cryptocurrencies within an IRA carries risks such as price volatility, regulatory uncertainties, and security concerns due to the decentralized nature of digital assets.

- Traditional assets in an IRA are subject to market fluctuations, economic conditions, and interest rate changes, posing risks related to market performance and overall economic stability.

Tax Implications and Benefits

Cryptocurrency in a Crypto IRA and traditional assets in a Traditional IRA have different tax implications and benefits. Let’s explore how these differences can impact your retirement savings.

Tax Implications of Holding Cryptocurrency

- When you hold cryptocurrency in a Crypto IRA, you can enjoy tax-deferred growth on your investments. This means you don’t have to pay taxes on any gains until you start making withdrawals.

- However, if you hold cryptocurrency outside of a retirement account, you may be subject to capital gains tax when you sell or trade your assets.

- It’s essential to note that the IRS considers cryptocurrency as property for tax purposes, which can affect how gains and losses are taxed.

Tax Benefits of Each Type of IRA

- With a Traditional IRA, you can contribute pre-tax dollars, reducing your taxable income for the year. This can lower your current tax bill and allow your investments to grow tax-deferred until retirement.

- On the other hand, a Roth IRA, which can hold traditional assets, offers tax-free growth and tax-free withdrawals in retirement, as long as certain conditions are met.

- Crypto IRAs combine the benefits of both traditional and Roth IRAs, providing tax-deferred growth like a Traditional IRA and potential tax-free withdrawals like a Roth IRA.

Tax Regulations and Changes by 2025

- As the popularity of cryptocurrencies continues to rise, tax regulations surrounding these assets are likely to evolve by 2025.

- The IRS may introduce new guidelines or regulations specific to cryptocurrency holdings in retirement accounts, impacting how these assets are taxed.

- It’s crucial for investors to stay informed about any tax changes related to Crypto IRAs and Traditional IRAs to make informed decisions about their retirement savings strategies.

Security and Regulation

Cryptocurrency investments within a Crypto IRA present unique security challenges compared to Traditional IRAs. The decentralized nature of cryptocurrencies and the lack of a central authority regulating them can pose risks to investors. On the other hand, Traditional IRAs are subject to stringent regulations and oversight by government agencies to protect investors’ interests.

Regulatory Oversight

- The SEC (Securities and Exchange Commission) plays a crucial role in monitoring and regulating the securities industry, including traditional investment options within IRAs.

- However, the SEC’s jurisdiction over cryptocurrencies is more limited, leading to potential gaps in investor protection for Crypto IRA holders.

- Regulatory bodies are still evolving their approach to regulating cryptocurrencies, which could impact the security of Crypto IRA investments in the future.

Security Measures

- Crypto IRAs often rely on secure digital wallets and encryption technology to protect investors’ holdings from cyber threats.

- Traditional IRAs, on the other hand, benefit from established security protocols and safeguards provided by financial institutions and regulators.

- Despite advancements in cybersecurity, the volatile and unregulated nature of cryptocurrencies introduces additional vulnerability to hacking and fraud.

Closing Notes

In conclusion, the comparison between Crypto IRA and Traditional IRA sheds light on the potential victor in 2025, leaving readers with a deeper understanding of the investment landscape.

Top FAQs

What are the tax implications of holding cryptocurrency in a Crypto IRA?

The tax implications of holding cryptocurrency in a Crypto IRA differ from traditional assets in a Traditional IRA, with specific rules and regulations governing each type of investment.

What risks are involved in investing in cryptocurrencies within an IRA?

Investing in cryptocurrencies within an IRA carries risks such as volatility, regulatory changes, and security breaches that differ from traditional asset investments.

![Benefits of Servicing Your Air Conditioning Regularly [2024]](https://finance.radarcirebon.tv/wp-content/uploads/2025/07/Benefits-of-Air-Conditioning-Servicing-on-the-Regular-Featured-Image-980x551-1-120x86.jpg)